Invoice Factoring vs. Credit Cards for Small Business Funding

Stringent lending requirements often make it difficult for small businesses to gain access to the working capital they need. When traditional small business loans are not an option, business owners may turn to one of a number of alternative financing options.

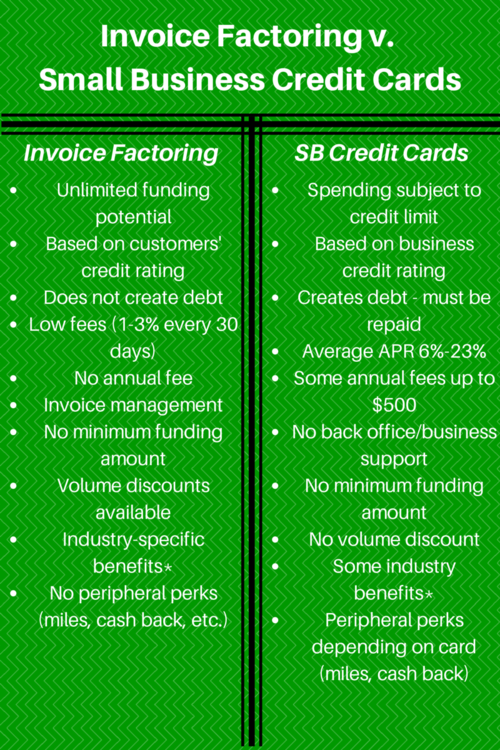

Two of those options, invoice factoring and small business credit cards, offer different benefits and come with different challenges for small businesses. Choosing the right option can be critical to continued success.

First, let’s break down what each financing option entails:

Small Business Credit Cards

Most banks and credit unions offer a variety of small business credit cards. These cards function similarly to personal credit cards. The small business is the account holder and any number of employees can be registered for a card in their name that is tied to the central account. Billing statements are issued monthly; some may require payment in full for the month while others allow you to carry a balance with interest accruing each month.

One feature of small business credit cards that is attractive to many business owners is the ability to accumulate points, miles, and other rewards for using the card at certain businesses. Cash back for qualifying purchases may also be a selling point. There is no restriction on the type of business that may apply for small business credit cards, whether you bill individual customers or other businesses.

Get Started Now

Secure the funds you need today. Complete the form or call.

Qualifying for a small business credit card account requires a “good” or better FICO credit score (and may be tied to the owner’s personal credit score). Above-average credit scores may open the door to a better interest rate, higher credit limit, or additional benefits – while a lower score may completely disqualify your business. A low or zero-percent interest rate is common for the first several months, after which interest accrues according to the current APR. Many credit accounts also come with an annual fee as well as balance transfer fees.

SAMPLE SMALL BUSINESS CREDIT CARD TRANSACTION

ABC Company makes a $1,000 purchase of office supplies on the company credit account. The account is not payable in full at invoicing so the business owner pays $100 per month at the current APR of 18%.

It will take 11 months to pay that single charge for a total interest of $91.62.

Which Type of Funding is Best for Your Business?

Now that you know the differences, it’s time to decide which funding option can provide the greatest benefits to your business.

If you generate a high volume of sales and consistently collect from your customers, your company may benefit from the perks offered by a small business credit card. By paying your balance in full during the card’s grace period (typically 21-25 days between the invoice date and the due date) you can avoid being hit with interest charges and take advantage of the “short-term loan” quality of a small business credit account.

If, on the other hand, your customers are slow to pay and your sales volume varies due to the season or other factors, an invoice factoring relationship can provide the fast access to cash that small business credit cards do without subjecting you to interest charges or requiring you to pay down a certain balance each month.

It is important to note that small businesses working directly with individual consumers are not eligible for factoring. However, if you still find that a small business credit card would harm your business more than help, there are additional funding options available including a number of unsecured business loans.

Factor Finders has relationships with invoice factoring companies nationwide that are ready to help small businesses in every industry improve their cash flow. Request a free quote today and be prepared to submit a few basic business documents and you can be approved to start factoring in as little as 3 to 5 business days, with initial funds transferred within 24 hours of account setup!

Start Invoice Factoring with Factor Finders Today!

Factor Finders has relationships with invoice factoring companies nationwide that are ready to help small businesses in every industry improve their cash flow. Request a free quote today and be prepared to submit a few basic business documents and you can be approved to start factoring in as little as 3 to 5 business days, with initial funds transferred within 24 hours of account setup!